Hermès : Scarcity as Strategy

Can the world’s most exclusive brand sustain its pricing power in a shifting luxury landscape?

🛡️ The Moat: Still Unbreakable?

Hermès is one of the world’s most iconic luxury houses — best known for its leather goods, timeless design, and unmatched commitment to craftsmanship. Its brand is synonymous with exclusivity, quality, and heritage, and its products often command multi-year waitlists and premium resale values.

From the coveted Birkin and Kelly bags to its growing categories in ready-to-wear, silk, and accessories, Hermès has created a business model defined not by volume, but by scarcity and control. While most luxury brands pursue rapid expansion and seasonal trends, Hermès focuses on slow, deliberate growth and understated prestige. But in a world of shifting consumer behavior and rising competition, is its moat still unbreakable?

Brand Prestige and Heritage - Hermès' brand equity is among the strongest in the world — built over nearly two centuries of family ownership, discreet marketing, and an unwavering focus on craftsmanship. It is the gold standard of "quiet luxury," prized by the ultra-wealthy and immune to trend cycles.

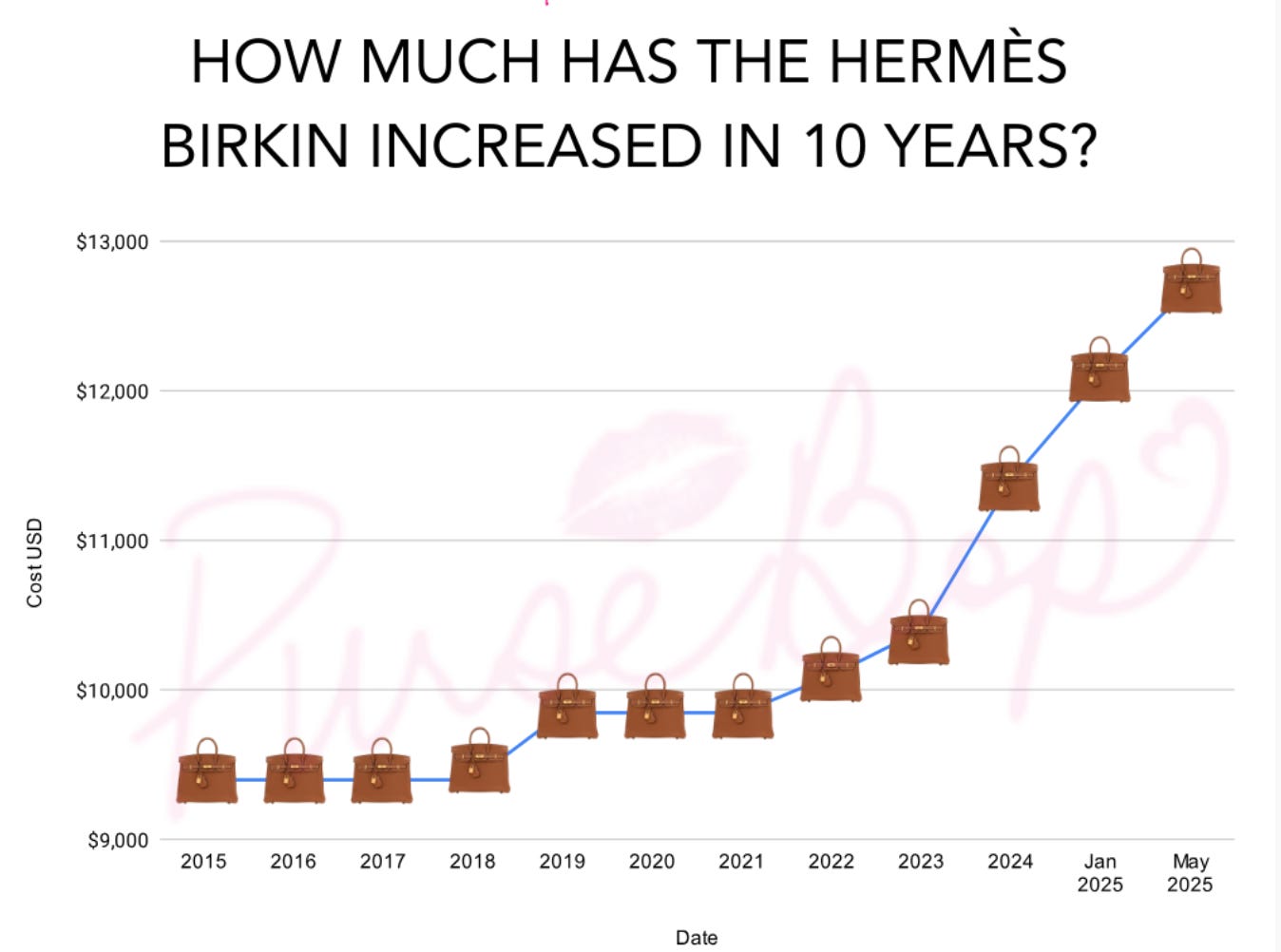

Supply-Limited Scarcity - Unlike most brands, Hermès intentionally limits production of its most iconic items, creating demand that consistently exceeds supply. This scarcity drives desirability, protects brand equity, and fuels pricing power — all while maintaining exclusivity across generations.

Craftsmanship and Vertical Integration - Hermès controls its production from start to finish, training artisans in-house and owning the tanneries and workshops that produce its goods. This integration ensures consistency and quality at a level that competitors struggle to replicate, reinforcing the brand’s elite positioning.

Source - Hermès Birkin Price Appreciation

🔍 Moat Under the Microscope: Is It Still Wide in 2025 — and Will It Stay That Way?

Generational Brand Equity - Hermès’ brand is its most valuable asset, but maintaining relevance across generations is a challenge. As luxury buyers skew younger, preferences are shifting toward casualwear, sustainability, and digital storytelling. The question: can Hermès remain aspirational without compromising its legacy?

Volume vs Exclusivity Tradeoff - Scarcity is central to Hermès’ model — but scaling too fast could erode that mystique. As the company expands into new geographies and categories (e.g. beauty), there’s a fine line between accessible luxury and overexposure. Missteps here could dilute pricing power and brand aura.

Luxury Disruption and Changing Tastes - Competitors like LVMH, Kering, and niche luxury brands are innovating with digital collections, collaborations, and AI-enhanced clienteling. Meanwhile, secondhand platforms and influencer culture are reshaping the luxury value chain. Hermès’ refusal to discount or follow trends is part of its appeal — but it could also risk brand rigidity in a fast-evolving market.

Having considered these points, it is important to note that Hermès still possesses a wide moat — underpinned by its unmatched brand prestige, vertical integration, and scarcity-driven pricing power. Its waitlist culture, family ownership, and artisan-centric identity remain peerless in the luxury world. Navigating demographic shifts, digital expectations, and cultural change — without losing its mystique — will be key to preserving its dominance.

Hermès Valuation

Now that we’ve discussed the strength of its moat, the next question is — what is Hermès worth today given an uncertain future?

Throughout this blog, I will be using a basic Discounted Cash Flow (DCF) model — essentially, it values Hermès based on how much cash it can generate in the future. Then we compare that to today’s stock price.

For the purpose of this analysis, I have used an average of Wall Street estimates for Hermès’ revenue growth, margins, and free cash flow assumptions. In the near term, I believe Hermès will continue to deliver resilient growth, supported by strong pricing power across its core leather goods business, elevated demand from affluent consumers, and expansion into underpenetrated regions such as Southeast Asia and the Middle East.

Its vertically integrated production model, disciplined distribution, and brand exclusivity provide robust earnings visibility and margin stability.

However, in the longer term, structural risks remain. As global luxury markets mature, volume-driven growth becomes harder to sustain without risking brand dilution. Generational shifts in consumer preferences, increasing demand for sustainability, and rising competition from digitally native or niche luxury brands may gradually pressure Hermès’ premium positioning. Additionally, macroeconomic volatility — particularly in China and the U.S. — could affect high-end discretionary spending.

To maintain its leadership and pricing power, Hermès will need to balance exclusivity with expansion, and evolve its brand relevance while defending its mystique.

Before moving onto the final valuation, for those who are new to finance, WACC (Weighted Average Cost of Capital) is effectively the average rate a company must pay to fund itself.

FCF (Free Cash Flow) is the money a company is free to use after spending on its operations and investments.

EV (Enterprise Value) is the total value of a company, combining its stock-market nd debt value, minus its cash — like the price someone would pay to buy the entire business.

💰 Valuation Output (in EUR, billions)

Present Value of FCF (2025-2034) = 49.27

Present Value of Terminal Value = 266.79

Entreprise Value = 316.06

Net Debt (2024) = -9.47

Equity Value = 325.53

Shares Outstanding = 0.105

Fair Value per Share = EUR 3100

📌 Final Take

Hermès remains a luxury outlier — a company that has built a business model on restraint, craftsmanship, and timeless appeal. Its vertically integrated production, near-mythical brand equity, and intentionally constrained supply give it rare pricing power and margin durability in the retail world. With multi-decade loyalty, limited promotional activity, and waitlists that span years, Hermès continues to operate in a category of one.

But even for a brand this strong, the narrative is subtly shifting. This is no longer a story of aggressive moat expansion — it’s one of strategic moat defense. Changing generational tastes, digital disruption in luxury, and the delicate balance between exclusivity and growth will test how Hermès evolves without compromising what makes it special.

Valuation-wise, Hermès currently trades around €2,350. My DCF analysis suggests a base-case fair value of €3,100, indicating meaningful upside from current levels. The market appears cautious — possibly reflecting concerns over macro headwinds, high-end consumer demand, or slowing growth — but the long-term investment case remains compelling for those seeking quality and durability.

Key Monitoring Points:

Whether Hermès can maintain scarcity and pricing power as it expands

Brand resonance with younger, digitally native luxury consumer

Execution in newer categories (beauty, Ready-to-Wear, home) without brand dilution

Macroeconomic impacts on discretionary spending, especially in China and the U.S.

My View (at EUR 2350/share):

Buy - for long-term investors seeking durable quality

Hold - best-in-class brand, still room to run

Re-evaluate if volume growth accelerates at the cost of exclusivity or margins begin to compress

Next Week on The Moat Edge:

Next week, I’ll be turning my focus to American Express (AmEx) — a unique player in the payments ecosystem, blending banking, brand loyalty, and a closed-loop network model.

We’ll explore how Amex has carved out a durable competitive edge through premium customer targeting, rewards-driven engagement, and deep integration across merchants and cardholders. In a world of rising fintech disruption, shifting consumer preferences, and regulatory scrutiny, is the moat still as wide as it once was?

I’ll also evaluate whether the current market valuation appropriately reflects its strong balance sheet, affluent user base, and earnings potential — or whether investors should tread carefully as economic uncertainty and competition heat up.

Stay tuned for a deep dive into trust, loyalty economics, and the future of premium payments.

Thanks for reading — and don’t forget to subscribe for weekly deep dives into wide-moat companies and valuations!

NOTE: The information provided in this post is for educational and informational purposes only. It should not be construed as financial advice or an endorsement to buy or sell any securities. Please conduct your own research or consult a financial advisor before making investment decisions.